Facts about the US healthcare system from a chronically ill person.

- “Good” insurance costs hundreds of dollars a month and takes thousands of dollars for them to start paying a percentage of your costs and more thousands for them to completely cover your healthcare costs.

- Medicare is not free and costs more than some people get paid a month. Not to mention only select doctors will see Medicare patients.

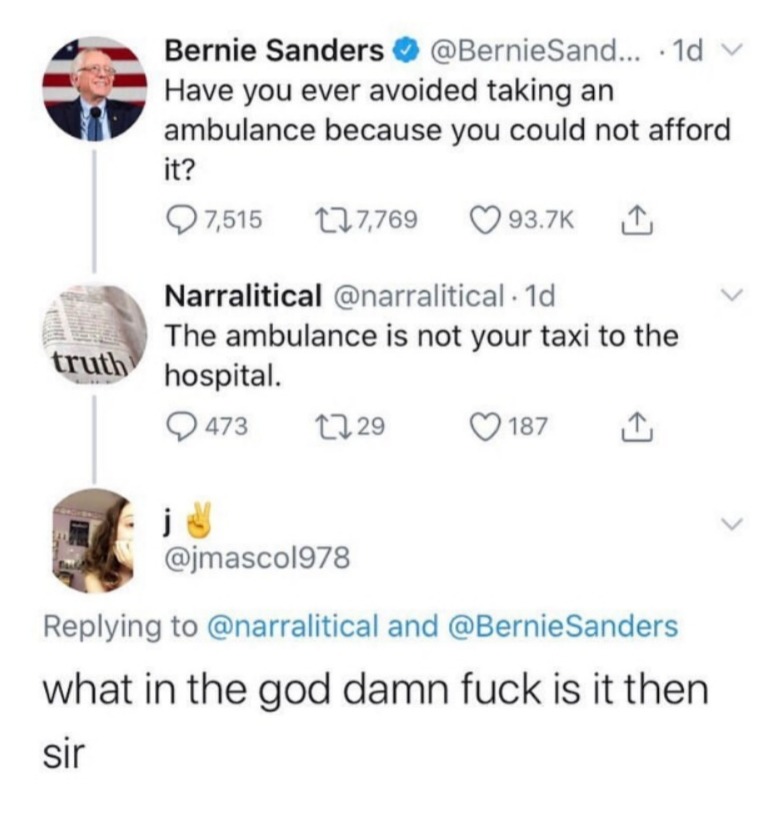

- While emergency rooms can’t technically refuse to treat someone because of no insurance they can still bill you all of the out of pocket costs they would have sent to the insurance company. (Think tens of thousands of dollars)

- Insurance can refuse to cover a medication even prescribed by a doctor because they don’t think you need it.

- If your insurance only covers some of your prescription but requires the pharmacy to cover the rest, so the cost doesn’t fall on you, the pharmacy can refuse to supply the medication. This sort of situation will make it difficult to get your prescription from any pharmacy.

- Some places have financial aid programs that help you receive your medications or medical supplies you need. Sounds nice, but if something is too expensive, they can refuse to supply it, just like above.

I’m tired of someone profiting over my health and my body. I’m me and I want to live my life, fall in love, have children, just like a healthy person, but I can only do that if I’m rich or am willing to live in debt my entire life.

I know for certain that if my parents hadn’t been helping me pay for everything, then I would have stopped seeking treatment long ago, become disabled earlier, and been unable to go to college and try to become a working member of society.

When will they learn that it’s cheaper to pay for health than it is to pay for disability.